CHECK MY FILE FREE 30 DAY TRIAL*

*£14.99 per month after free trial, can be cancelled any time

If you are buying a new home, remortgaging to a better deal or taking out finance, you may be asking yourself “how does my credit score affect the mortgage I can get?” Well don’t worry, ME has put some useful information together to help make it clear!

What Actually is a Credit Score?

Whenever you take out a finance agreement, such a loan, credit card, car finance, buy-now-pay-later or even a mobile phone contract, the lender (creditor) will record how well you conduct those accounts on a month-to-month basis, via credit reference agencies (or credit bureaus).

So when you are applying for credit, the lender will review your credit record and rate you basing their decision on your history and how well you have managed your credit in the past.

Credit Reports & Credit Scores

Contrary to popular belief, there are 3 main credit reference agencies, these are Experian, Equifax and Transunion. There are a number of different providers such as Credit Karma and ClearScore which offer you a free report, but they all use information collected by the main 3 agencies.

The information stored by a credit bureau is known as a Credit Report. This information is is basically a breakdown of your previous payment history as explained above. The agency will use this information to produce a rating or ‘score’ which lenders will use to make decisions about agreeing credit facilities for you. The higher the score the more likely you will be accepted for credit.

What sort of things affect my Credit Score?

There are 5 main factors that impact your score:

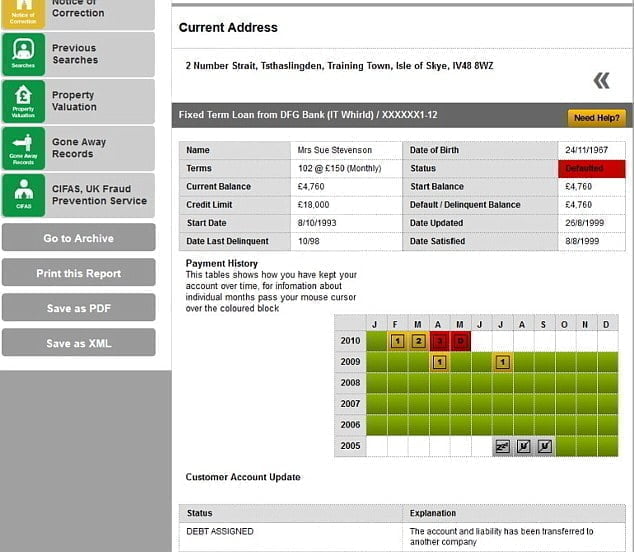

Payment History: For each of your credit accounts you have will have a month by month record of payments you have made. This is represented by a number, usually “0” to “6” and represents how many months you have missed.

Account Types: Having multiple types of credit accounts such as revolving credit (like credit cards) and regular monthly facilities such as loans and car finance, shows you can manage various types of facility.

Credit Utilisation: This is the amount of your available credit you are using over all of your facilities. If you are using 100% of your available credit, it could look like you are too dependent on your credit affecting your score.

You should aim to use less than 30% of your available credit, for example if you have £10,000 credit limit on your credit cards, try to not continually exceed £3,000.

Credit Searches/Inquiries: When you apply for credit and the provider runs a search, it can leave a ‘footprint’ on your file. Too many credit searches in a short period of time can have an impact on your ability to be accepted for credit (normally from 4 – 6+ searches in a month).

When applying for an agreement in principle for a mortgage, some lenders will perform a ‘soft search’ first which won’t leave a detrimental mark on your report, this would usually be followed up with a ‘hard search’ at full application. Having a good mortgage broker who understands how each lender works is beneficial.

Length of History: The last important factor to consider is the length of time you have had your credit facilities. A lender will look more favourably if you have ran your existing credit accounts for 10 years or more rather than 4 months.

What is Adverse Credit?

Adverse credit is a term used to describe someone with a less than perfect credit record. There are a number of specific events on your report which can have a detrimental effect on your ability to borrow money:

- Missed / Late Payments: If you have ever missed a payment on credit facility, this will be noted on your credit report.

- Defaults: If a credit provider is not satisfied how you have repaid your finance with them because you are behind on your payments, they may mark the account as defaulted. A default can be marked anywhere from 3 – 6 months+ but this all depends on the credit providers terms.

- County Court Judgements (CCJs): If a creditor feels they won’t get back the money which is owed to them, they may seek involvement from the courts. If the courts rule in the creditor’s favour, this will be recorded on your file.

- Debt Management Plans: This is when you have made an informal arrangement with your creditors to pay back a set amount per month. You may have made an ‘arrangement to pay’ with your creditors directly or via a Debt Management Company like ‘Step Change’. These won’t necessarily show on your credit report but will affect your credit as you won’t be making your full payment to your creditors so this will show as missed payments and arrears on your report.

- Individual Voluntary Arrangements (IVA): This is a formal arrangement made with your creditors via an Insolvency Practitioner. If accepted, you will pay an agreed amount back to your creditors on a monthly basis. An IVA usually lasts 5 years and can allow you to have more control over your assets whilst still potentially having debts written off. This will clearly leave you looking less favourable to a lender though.

- Bankruptcy: You can apply for bankruptcy usually if your debts way outweigh your assets. Your creditors will write of your debts (most of the time) but this will normally involve selling your assets with material value, including your home.

Can I get a mortgage with Bad Credit?

In a word, Yes! Although it’s not always that straight forward.

If you have a number of minor indiscretions such as a missed payment to a utility company 3 years ago, you are probably OK. Most high street lenders will have a tolerance for these ‘one offs’ and as long as your credit score is acceptable, these can often be ignored.

For more significant adverse credit issues such as defaults and CCJ’s, your options may be reduced. The more recent the adverse credit, the more restricted your options may be. For example, you are likely to pay a higher interest rate, the amount you can borrow could be affected and you may also be required to provide a larger deposit.

In Summary…

Understanding your credit can be very confusing leaving you feeling like you don’t know where to turn. If you are looking to apply for a mortgage and need help in understanding your options, feel free to CONTACT ME today and speak to one of our friendly advisers.

There are a number of different services available to produce your credit report, if you are applying for a mortgage, we recommend the following as they show exactly what we need to know:

CheckMyFile – This is our favourite! It shows ALL 3 main credit reports in a clear and easy was to read so all the information is to hand. You get a free 30 day trial too! – (after the FREE TRIAL subscription is £14.99 per month and can be cancelled at any time)

ClearScore – Free!

Experian Statutory Report – £2.00

Equifax Statutory Report – £2.00

Transunion Statutory Report – Free

Other free services you may find helpful:

Thank you for reading!

IMPORTANT: Please be aware by clicking on to the above links you are leaving the ME Financial Services Ltd website. Please note that ME Financial Services Ltd nor HL Partnership Limited are responsible for the accuracy of the information contained within the linked site(s) accessible from this page.

ME Financial Services Ltd are affiliated with Check My File and will receive a commission from them should you sign up to their services